When Should I Report An Address Change To Irs

When you movement, information technology seems there are countless entities that need your new accost—credit card companies, magazine subscriptions, fettle memberships, etc.—and odds are high that you're going to forget to modify your address with a couple of them. But what about updating your accost with the IRS? Most people don't have this at the forefront of their mind when making a list of entities to which they must submit a change of address. In some cases, withal, failing to update your accost with the IRS can accept major consequences. Proceed reading to learn more.

When you movement, information technology seems there are countless entities that need your new accost—credit card companies, magazine subscriptions, fettle memberships, etc.—and odds are high that you're going to forget to modify your address with a couple of them. But what about updating your accost with the IRS? Most people don't have this at the forefront of their mind when making a list of entities to which they must submit a change of address. In some cases, withal, failing to update your accost with the IRS can accept major consequences. Proceed reading to learn more.

Why Yous Should Update Immediately

There'due south a reason near people don't think of the IRS when they're making a list of entities that need their new accost; y'all likely only bargain with the IRS one time a year, and when you submit your next taxation return, they'll get your new address anyways. While this is true, any tax-related communications they send between your move and when you file your adjacent render will be sent to your old address. And when the IRS sends you a letter, it'due south usually something you don't want sent to the wrong house.

For example, the IRS may send a letter of the alphabet regarding your taxes that requires a prompt reply. By sending the observe to the accost they accept on file, the IRS has fulfilled their legal obligation to notify y'all of any issues related to your taxes; they are non responsible for an incorrect address. Even if you didn't receive the alphabetic character because you no longer alive in that house, whatsoever repercussions arising from your lack of response (late fees, penalties, having your account sent to collections, etc.) are still your ain responsibleness.

If y'all have your taxation refund sent via check, and you lot move while awaiting your refund, your bank check volition exist sent to your sometime address. Of course, odds are that the check will make its way to your new home somewhen. However, there will be pregnant delays in your receipt of those funds.

While you lot may already have a list a mile long of companies that need your new address, it's important to add together the IRS to that list, rather than waiting until you file your taxation return. Even if you feel certain that the IRS has no reason to accomplish out to yous before you file, the few minutes it takes to update your accost are a minor cede to make when compared to the potential consequences of not doing it.

How to Submit a Change of Address

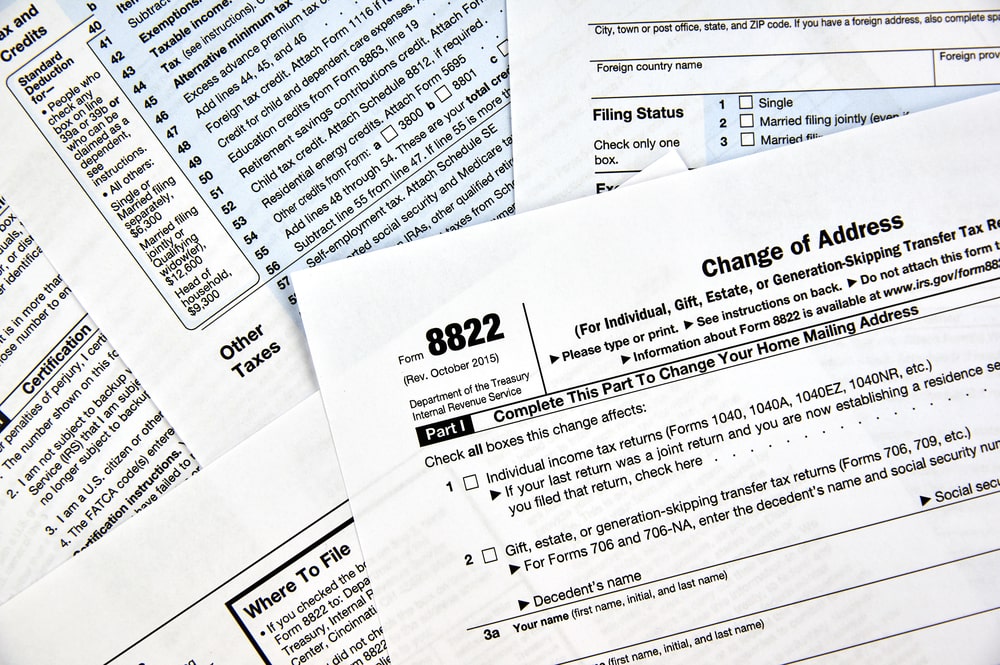

You have 3 options available to you lot for updating your accost with the IRS. The first is to fill out and submit an IRS modify of address form. A alter of address with the IRS must be submitted on paper, only it doesn't take long. You can print and fill out Form 8822 from the IRS website. The second page of the form will tell you what address you should mail it to, based on your previous accost. Please ensure that you are sending the document to the correct IRS division based on your onetime address, not your new one.

Your second option is to write upwardly and sign a statement that includes all of the following data:

- Total name

- Previous address

- New address

- SSN, ITIN, or EIN

Yous must so mail your written statement to the same location where you lot mailed your final taxation return.

Your final choice is to give an oral notification of your alter of residence. If you alive near an IRS office, you can do this in person; yous tin can also call the IRS and provide notification over the phone. They practise need to verify your identity to update your accost, so make sure you can provide your full name, date of nascence, accost, and SSN, ITIN, or EIN when requested.

Forms for Spouses and Independent Children

If yous have developed children who alive with you only file their own revenue enhancement returns, they will need to complete and submit a separate change of address form. This applies to each kid in your domicile who files carve up taxes.

All the same, you and your spouse tin utilise the aforementioned modify of accost class, regardless of whether yous file separately or jointly, so long as yous're however living together. If you and your spouse take established divide residences, yous will demand to each submit your own change of address form.

It'due south important that the IRS ever have your current address, so you lot can ensure you lot're receiving all tax-related notifications. If you lot're a client of Demian & Visitor CPAs, we can help you with updating your address with the IRS so that you have one less thing to worry about.

Source: https://taxprocpa.com/blog/updating-address-with-IRS-how-to-and-why-it-matters/

Posted by: pascodomesed.blogspot.com

0 Response to "When Should I Report An Address Change To Irs"

Post a Comment